In this article, we’ll learn what liquidity is in trading, what Liquidity Sweep and Liquidity Grab mean, and how they’re used in the Smart Money Concept. Complete information in English.

“Liquidity” is a term in trading that’s crucial for every trader to understand. Many new traders wonder why the market suddenly hits their stop loss and then moves in the same direction. The answer lies in understanding liquidity and Liquidity Sweep/Grab.

In this blog, we’ll explore what liquidity is, what liquidity sweep and liquidity grab mean, and easy ways to identify them on charts

💡 What is Liquidity? (What is Liquidity in Trading)

Simply put, liquidity means the ability to buy and sell (the presence of buyers and sellers) in the market. But when we talk about the Smart Money Concept, liquidity refers to the area where most traders have placed stop-loss or pending orders.

🔹What is a Liquidity Zone?

A Liquidity Zone is an area where a large number of traders have placed their stop-loss (SL) or limit orders. These zones are often targeted by large institutions and Smart Money.

For example:

- If many traders have bought, their SLs will be lower → this creates Sell-Side Liquidity (SSL).

- If many traders have sold, their SLs will be higher → this creates Buy-Side Liquidity (BSL).

📊What is a Liquidity Pool?

A Liquidity Pool is an area where a large number of stop-loss or pending orders accumulate in the market. These are mostly found around previous Swing Highs and Swing Lows.

📍 Example:

Suppose the price is trading at 22500 and the previous high is at 22600. Many traders have placed stop losses above 22600.

So, a Buy-Side Liquidity Pool exists above 22600.

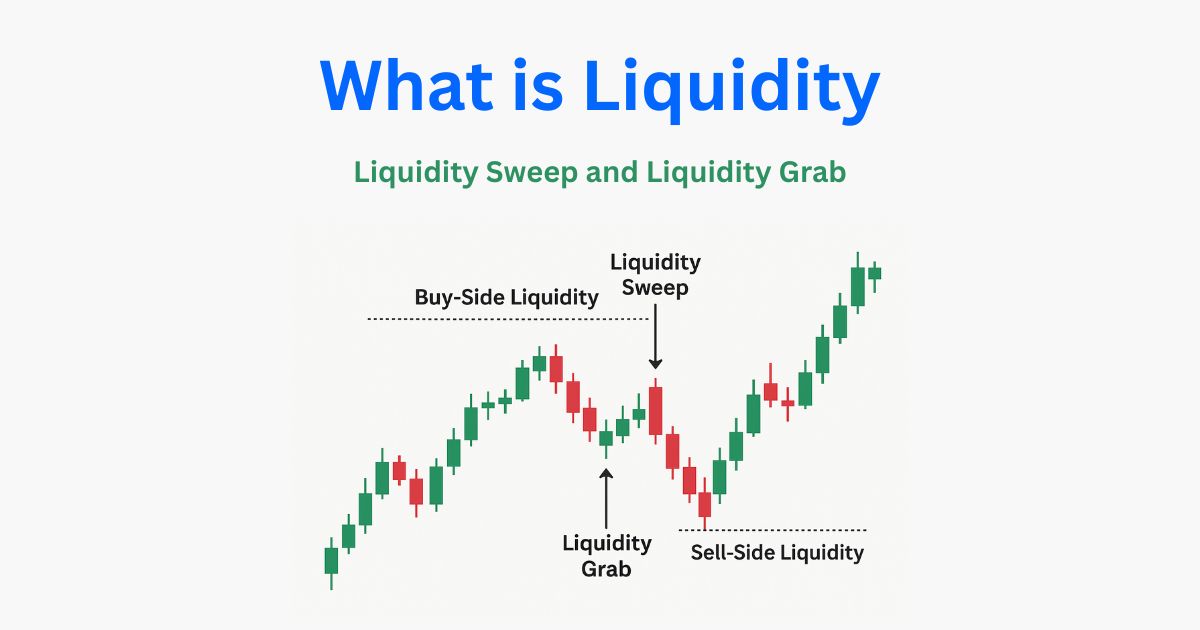

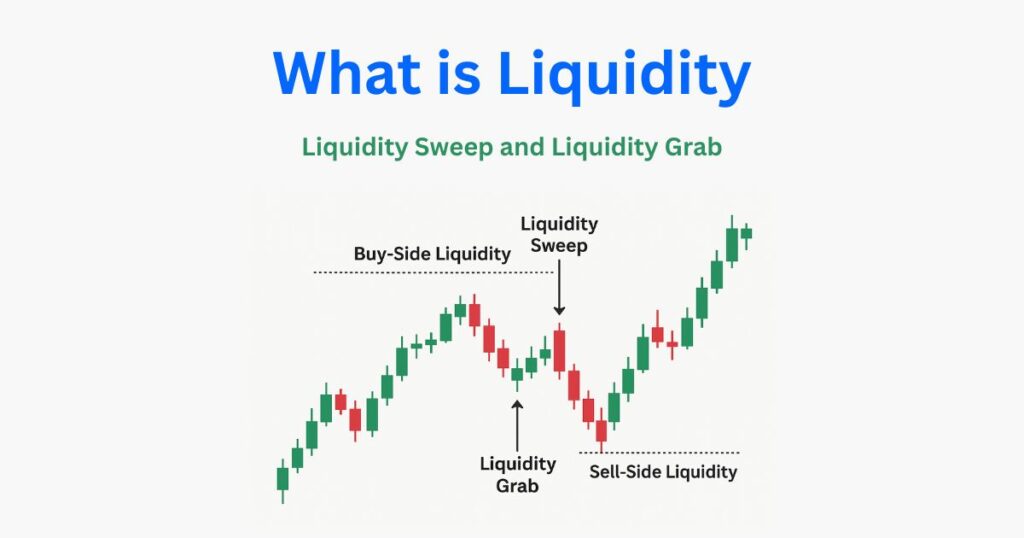

⚡ What is a Liquidity Sweep?

A Liquidity Sweep means the market deliberately breaking a high or low to trigger a hidden stop loss. This is similar to a false breakout, where the market moves up or down for a period of time, clears liquidity, and then reverses and moves in the original direction.

🧩 Example of a Liquidity Sweep:

- Suppose a double top has formed on a chart.

- There are many buy stops above the upper high.

- The market breaks that high, sweeping away liquidity.

- The market then falls downwards.

👉 This move is called a Liquidity Sweep.

🎯 What is a Liquidity Grab?

Liquidity Grab means when smart money or institutions activate stop losses and fill their large orders. This is part of the same process as a Liquidity Sweep, except here the focus is on the Smart Money grabbing liquidity and making their entry.

🔍 Difference Between Liquidity Sweep and Liquidity Grab.

| Comparison Point | Liquidity Sweep | Liquidity Grab |

|---|---|---|

| Definition | When the market hits a liquidity zone | When Smart Money collects liquidity |

| Objective | To trigger stop losses | To fill large institutional entries |

| Result | Causes a false breakout | Leads to trend reversal or trend continuation |

| Main Focus | Price action movement | Smart Money entry zones |

🧭 Why does liquidity happen?

Liquidity occurs because:

- Every trader places a stop loss on their trade.

- These SLs become a type of pending order.

- When the market reaches that level, these orders add liquidity to the market.

- Smart money uses these orders to complete their entry.

This is why the market often reverses where the most people have placed SLs.

📈 How to Identify a Liquidity Sweep and Liquidity Grab on a Chart?

There are some specific clues to identify liquidity: 👇

- A sharp wick forming above/below a swing high or swing low.

- A sharp reversal candle appears after that level.

- A volume spike appears, meaning a sudden increase in volume.

- A Break of Structure (BOS) or Change of Character (ChoCh) appears in the market structure.

Candlestick Patterns Such as:

- Pin Bar

- Rejection Candle

- Engulfing Pattern

🧠 The Importance of Liquidity in Smart Money Concepts (SMC).

Liquidity plays a crucial role in Smart Money Concepts. Institutional traders need liquidity to fill their large orders.

They know:

- Where retail traders’ stop losses are located

- Where liquidity is accumulated

- And when to move the market there

So, they first grab liquidity and then steer the market in its true direction.

💥 The Basic Idea of a Liquidity Trading Strategy.

- First, identify the Liquidity Zone (Swing Highs/Lows).

- See if the market has “sweeped” from there.

- If the Market Structure Breaks (BOS) after the sweep, an entry point can be found.

- Place the Stop Loss above or below the previous high/low.

Target the next opposite liquidity zone.

📘 A quick example:

Let’s say a strong low forms on a chart—and several stop-losses are placed below it.

🔹 The market falls → breaks the low (Liquidity Sweep)

🔹 Smart Money places its buy entry there (Liquidity Grab)

🔹 The market then moves sharply upwards.

This is an example of a classic Liquidity Grab entry.

Disclaimer: The information provided in this article is for educational purposes only. If you want to invest in the stock market, you should learn about the stock market yourself or consult a financial advisor and a certified expert. The stock market is risky. Before making any investment, you should consult an expert.

🏁 Conclusion

This article explains why understanding liquidity is essential for every trader, as markets move where there is liquidity. Liquidity Sweep and Liquidity Grab tell us when and where Smart Money is executing its orders. If you learn to recognize these on the charts, you can avoid “Stop Loss Hunting” and trade with Smart Money, as explained in detail. If you enjoyed the information in this article, please like, share, and comment.

👉 Read also: What is an Order Block (OB)? | Smart Money Concept Trading Guide.